Blog

Black Scholes Merton (BSM Model)

The financial world is complex, yet understanding its fundamental tools can significantly enhance your trading and investment strategies. One such critical tool is the Black-Scholes-Merton (BSM) model, a mathematical model used for pricing options and assessing financial derivatives. This blog delves into the core components of the BSM model, its applications in trading and risk management, and its relevance in today’s finance landscape.

One of the key ideas in contemporary finance theory is the Black-Scholes model. This mathematical formula, also referred to as the Black-Scholes-Merton (BSM) model, calculates the theoretical value of derivatives based on other investment instruments while accounting for the effects of time and other risk variables. It was created in 1973 and is currently thought to be among the most effective methods for setting an options contract price.

GARP : https://www.garp.org/

The Core Components of the BSM Model

At its heart, the BSM model is built on several key components that are vital for option pricing:

- Underlying Asset Price: The current price of the asset for which the option is being priced.

- Strike Price: The predetermined price at which the underlying asset can be bought or sold.

- Time to Expiration: The time remaining until the option contract expires.

- Risk-Free Interest Rate: The theoretical rate of return on an investment with zero risk, typically represented by government bonds.

- Volatility: A measure of the asset’s price fluctuations over a specified period.

Key Takeaways

- The Black-Scholes-Merton, or BSM, model is another name for the Black-Scholes model.

- Options contracts are frequently priced using this differential equation.

- The striking price of an option, the current stock price, the time to expiration, the risk-free rate, and volatility are the five input variables needed by the Black-Scholes model.

- Although the Black-Scholes model is generally correct, it has some assumptions that may cause forecasts to differ from actual outcomes.

- Because it ignores the possibility that American options may be exercised prior to their expiration date, the typical BSM model is exclusively used to price European options.

History of the Black-Scholes Model

The first popular mathematical technique to determine the theoretical value of an option contract was the Black-Scholes model, which was created in 1973 by Fischer Black, Robert Merton, and Myron Scholes. Current stock prices, anticipated dividends, the strike price of the option, anticipated interest rates, the time to expiration, and anticipated volatility are all taken into consideration.

In their 1973 work “The Pricing of Options and Corporate Liabilities,” which was published in the Journal of Political Economy, Black and Scholes presented the first equation. The paper was edited in part by Robert C. Merton. Later that year, he wrote an essay titled “Theory of Rational Option Pricing” that was published in The Bell Journal of Economics and Management Science. In addition to developing the model’s mathematical applications and comprehension, he also came up with the phrase “Black–Scholes theory of options pricing.”

The 1997 Nobel Memorial Prize in Economic Sciences was to Scholes and Merton for their efforts in figuring out “a new method to determine the value of derivatives.” Since Nobel Prizes are not awarded posthumously, Black was not eligible to receive one because he had died two years prior. But his contribution to the Black-Scholes model was recognized by the Nobel Committee.

Important Components

Understanding these components is crucial, as they directly influence the calculated option prices. For example, an increase in volatility generally leads to higher option premiums due to the greater uncertainty regarding future asset prices. Conversely, an increase in the risk-free rate may lead to lower call option prices, as the present value of the strike price decreases.

How the Black-Scholes Model Works

According to Black-Scholes’ theory, financial assets like stock shares and futures contracts will exhibit a lognormal distribution of prices that follow a random walk with continuous volatility and drift. The price of a European-style call option is calculated using this assumption as well as other significant variables.

Six variables are needed to solve the Black-Scholes equation: volatility, the price of the underlying asset, the option’s strike price, the amount of time until the option expires, the risk-free interest rate, and the type of option (call or put). Theoretically, options dealers may use these factors to determine reasonable prices for the options they are offering for sale.

According to the model, the price of assets that are exchanged frequently moves in a geometric Brownian motion with continuous volatility and drift. When applied to a stock option, it takes into account the time value of money, the strike price of the option, the time to expiry, and the stock’s continuous price fluctuation.

What is a Hedging Strategy?

Black-Scholes Assumptions

Some presumptions are made by the Black-Scholes model:

- Throughout the option’s duration, no dividends are distributed.

- Because market fluctuations are unpredictable, markets are random.

- Purchasing the option has no transaction fees.

- The underlying asset’s volatility and risk-free rate are known and consistent.

- The underlying asset’s returns follow a normal distribution.

- The European option is only exercisable at expiration.

The impacts of dividends paid throughout the option’s life were not taken into account by the original Black-Scholes model; however, the model is commonly modified to take dividends into account by calculating the underlying stock’s ex-dividend date value. Many market makers that sell options additionally alter the model to take into consideration the impact of options that can be exercised before expiration.

CFA vs. FRM Or Both – Which One Should You Choose?

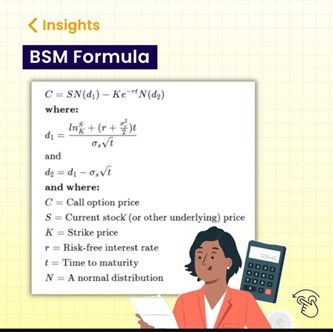

The Black-Scholes Model Formula

Using Black-Scholes modeling in your tactics doesn’t require you to study or even comprehend the formula’s complex and sometimes daunting mathematics. Numerous online options calculators are available to options traders, and numerous trading platforms feature powerful options analysis tools, such as spreadsheets and indicators, that carry out the computations and produce the options pricing values.

Multiplying the stock price by the cumulative standard normal probability distribution function yields the Black-Scholes call option formula. The value obtained from the previous computation is then removed from the strike price’s net present value (NPV), which is calculated by multiplying it by the cumulative standard normal distribution.

Interest Rate Parity (IRP)

and where:

C=Call option price

S=Current stock (or other underlying) price

K=Strike price

r=Risk-free interest rate

t=Time to maturity

N=A normal distribution

Computing Option Prices Using BSM

To compute option prices using the BSM model, you need to gather the necessary inputs: the current price of the underlying asset, the strike price, time to expiration, risk-free interest rate, and the asset’s volatility. Once these values are inputted into the formula, you can derive the theoretical price of the option.

This computational method provides traders and investors with a standardized approach to valuing options, enabling them to make informed decisions based on market conditions.

Application of the BSM Model

Applications of the Black-Scholes-Merton Model in Trading

The BSM model is widely utilized in trading strategies. Traders use it to price options accurately, allowing them to identify underpriced or overpriced options in the market. This pricing model helps traders decide when to buy or sell options based on market sentiment and potential future movements in the underlying asset’s price.

Importance of the Black-Scholes Model in Finance

The BSM model’s significance extends beyond trading; it serves as a cornerstone for modern financial theory. It provides a framework for understanding how various factors affect option pricing, thus influencing broader financial markets. The model’s insights contribute to efficient market theories and the overall understanding of risk and return.

Black-Scholes Model for Risk Management Strategies

In risk management, the BSM model aids in developing hedging strategies. By understanding how options are priced, risk managers can create effective hedges to protect their portfolios against market volatility. This is particularly important in today’s uncertain financial landscape, where effective risk management is essential for preserving capital.

Limitations and Adaptations

Despite its widespread use, the BSM model is not without limitations. It assumes constant volatility and interest rates, which rarely hold true in real-world scenarios. Additionally, the model is designed for European-style options, which can only be exercised at expiration. However, many market participants have adapted the model to account for American-style options and fluctuating market conditions, thereby enhancing its applicability.

Benefits of the Black-Scholes Model

Because of its various advantages, the Black-Scholes model has been effectively applied and utilized by numerous financial professionals.

Offers a Structure: Options pricing is theoretically supported by the Black-Scholes model. This enables traders and investors to ascertain an option’s fair pricing through a methodical, well-defined, and tried-and-true process.

Enables Risk Management: By understanding the theoretical value of an option, investors can utilize the Black-Scholes model to control their risk exposure to different assets. Therefore, investors can utilize the Black-Scholes model to analyze portfolio weakness and regions of deficient investment in addition to assessing possible returns.

Enables Portfolio Optimization : By giving a measure of the predicted returns and hazards connected to various options, the Black-Scholes model may be used to optimize portfolios. As a result, investors are able to make more informed decisions that better suit their risk tolerance and profit-seeking objectives.

Increases market efficiency: Because traders and investors are more adept at pricing and trading options, the Black-Scholes model has increased market efficiency and transparency. Because there is a higher implicit awareness of how prices are derived, the pricing process is made simpler.

Simplifies pricing: Financial industry practitioners often embrace and apply the Black-Scholes model, which enables more uniformity and comparability across markets and countries.

What Are the Inputs for the Black-Scholes Model?

Volatility, the price of the underlying asset, the option’s strike price, the amount of time until the option expires, the risk-free interest rate, and the kind of option are the inputs for the Black-Scholes equation. With these factors, options sellers might theoretically establish reasonable prices for the options they are offering for sale.

You will Know More: https://fintelligents.com/

Conclusion

In conclusion, mastering the Black-Scholes-Merton model is essential for anyone serious about a career in finance or trading. By understanding its components, applications, and limitations, you can make informed decisions that enhance your financial strategies. For those looking to deepen their knowledge and gain expertise in financial concepts like the BSM model, enrolling in classes at Fintelligents in Mumbai can provide the guidance and support needed to succeed. Invest in your education and unlock your potential in the world of finance!